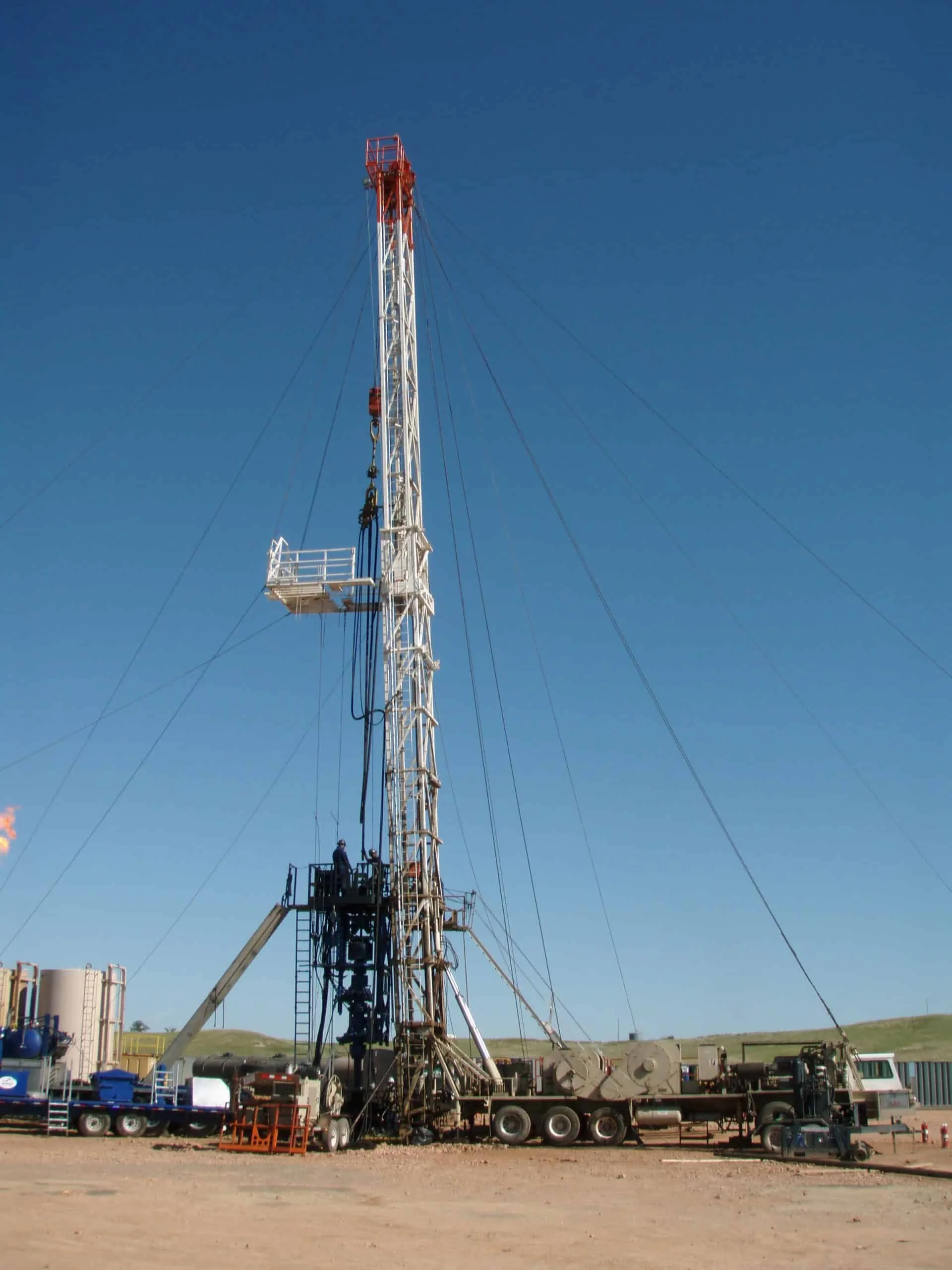

At William D. Goodwin, Inc., investors participate directly in producing oil and gas assets — not funds, not paper trades.

Each project is structured so partners own a working interest in real wells with tangible production, equipment, and reserves. This approach provides both monthly income and significant tax advantages unavailable in most asset classes.

Direct Ownership. Real Assets. Monthly Cash Flow.

We focus on proven, cash-flowing properties with upside through reworks or optimization — not speculative drilling.

Our acquisition criteria include:

Existing daily production

Low decline, conventional reservoirs

Opportunities to add value through recompletions or LOE reduction

Clear title, infrastructure in place, and defined plugging obligations

We Source and Evaluate Projects

2. Investors Participate Alongside the Operator

Each project is structured as a Joint Venture, LP, or Working Interest (WI) partnership.

Investors own a direct share of production and revenue, proportionate to their interest.

You receive:

Monthly production and revenue reports

Direct deposit distributions from your share of sales

Year-end tax documents for depletion and depreciation deductions

You participate in the same economics as the operator — aligned interests, transparent accounting.

Oil and gas ownership offers unique tax advantages:

Depletion Allowance: 15%

Bonus Depreciation (80% in 2025): Existing production equipment value at purchase

Depreciation: Remaining depreciation over 5-7 years

Intangible Costs: Value-add project costs are largely intangible

3. Tax Benefits

4. Ongoing Management and Reporting

We handle the operations, field supervision, accounting, and regulatory compliance.

Our focus:

Reducing lease operating expenses (LOE)

Enhancing production via recompletions or compression upgrades

Maintaining environmental and plugging compliance

You receive monthly updates and performance summaries — simple, transparent, and professional.

Most projects are structured for 3–5 year holds.

Returns come from:

Monthly cash distributions, and

Sale or refinancing of the asset once value has increased through higher prices or improved production.

This approach mirrors real estate — collect yield while building equity in the underlying asset.